Presidential Candidate Robert F. Kennedy Jr. to Announce Small Business...

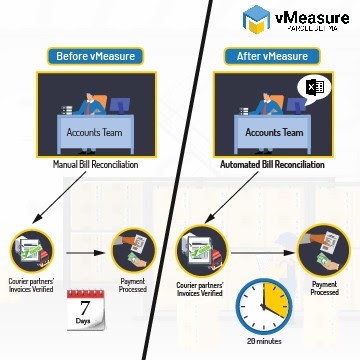

Beyond Dimensioning: How vMeasure Changed Parcel Measurements and Finance Together ...

The 17 Hottest Trending White Label Products to Sell in...

Are You Taking Advantage of Accounting Automation in your E-commerce,...

Resilience and Revolution: Franco Cavaleri's Journey to Transforming Health Through...

INNOVATIONS IN TECHNOLOGY TO ADAPT TO EVOLVING CONSUMER BEHAVIORS...

Introducing White Label World Expo...

Sustainability – now with 20-20 vision!...

Engage the senses and sell more....

BUILD YOUR BRAND: IDENTIFYING TRENDS IN THE BIZ...

CREATING A PERSONAL GROWTH PLAN FOR 2023...

White Label World Expo Las Vegas...

Parcel Monitor: Top Logistics Trends to Embrace in 2023...

As we age, our body changes...

What is Ecommerce? Definition, Types of Ecommerce and FAQ...

Carrier Performance During Peak Season...

Top Packaging Trends 2023: “Plastics circularization” leads sustainability charge amid...

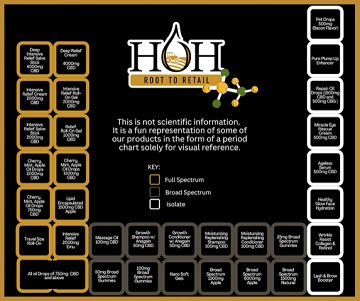

The Holy Trinity of Hemp...

Parcel Monitor: Top Logistics & Supply Chain Challenges of 2022 ...

Vitamin and Supplement Contract Manufacturer NutraPak USA Moves into New...

UK eCommerce Events 2022...

State of Europe E-Commerce in Peak Season 2021...

One Stop Shop: How The EU Regulation will Affect...

Cannabis vape entrepreneur aims to make his device ‘the medical...

Join The CANNAVIST Business Network...

White Label World Expo Series Wins Award for the Best...

What to do to go into your own business?...

Will cannabis legalisation have a positive or negative impact on...

Content businesses use a variety of business models.....

Most e-liquids do not meet legal requirements for packaging, study...

1

2